Statements

A statement is a disclosure of the state of an account, and its activity, over a billing period. Synctera will generate a statement payload for any account that requires periodic statements to be provided to the customer, through the Statements API. These payloads are made available at the end of every billing period, which is usually from the first to the last day of a calendar month.

At this time, Synctera does not generate a printable version of a statement.

Prerequisites

This guide assumes that you are already familiar with the customer and account APIs, and have one or more accounts created.

If this is not the case, refer to the following guides:

Statement generation

The V0 version of this API only supports statements for

CHECKINGandSAVINGaccounts. More account types will be supported in future versions.

A statement is generated automatically at the end of an account's billing period. At this time, billing frequency is monthly, meaning that at the end of every calendar month a bank statement will be generated for every eligible account:

| Account type | Eligibility |

|---|---|

CHECKING | Eligible, but only if the account was active during the statement period |

SAVING | Eligible |

Once a statement is generated, a notification will be sent via webhook. Please refer to the Webhook Events section for details.

Statement content

In order to produce regulatory-compliant, human-readable statements, this API provides the following information:

| Section | Field(s) | Description |

|---|---|---|

start_date and end_date | The date interval covered by the statement, inclusive. | |

issue_date | The date the statement was issued. | |

opening_balance and closing_balance | The final posted balances recorded at the beginning of start_date and at the end of end_date. | |

disclosure | A suggested disclosure statement to display. | |

transactions (deprecated) | A list of transactions posted during the statement period. This field is deprecated, please see this section for details. | |

account_summary | - | Information about the account. |

account_summary | financial_institution | Information about the financial institution managing the account. |

customer_service_details | - | Contact information for use by the customer if they wish to dispute the information in this statement. |

primary_account_holder_personal | - | When account_summary.customer_type is PERSONAL then primary_account_holder_personal contains information about the person acting as primary account holder. |

primary_account_holder_business | - | When account_summary.customer_type is BUSINESS then primary_account_holder_business contains information about the company holding this account. |

joint_account_holders | - | A list of all individuals designated as joint account holders for this account. |

authorized_signer | - | A list of all individuals designated as authorized signers for this account. |

savings_summary | apy | If the account has an interest product associated with it, this field will describe the APY earned based on the interest payout in this period. |

savings_summary | interest_earned and interest_earned_ytd | If the account has an interest product associated with it, this field will describe the interest earned on during this billing period, and the sum of interest earned during the calendar year. |

For more details about the schema returned by this API, please refer to the Statements API specification.

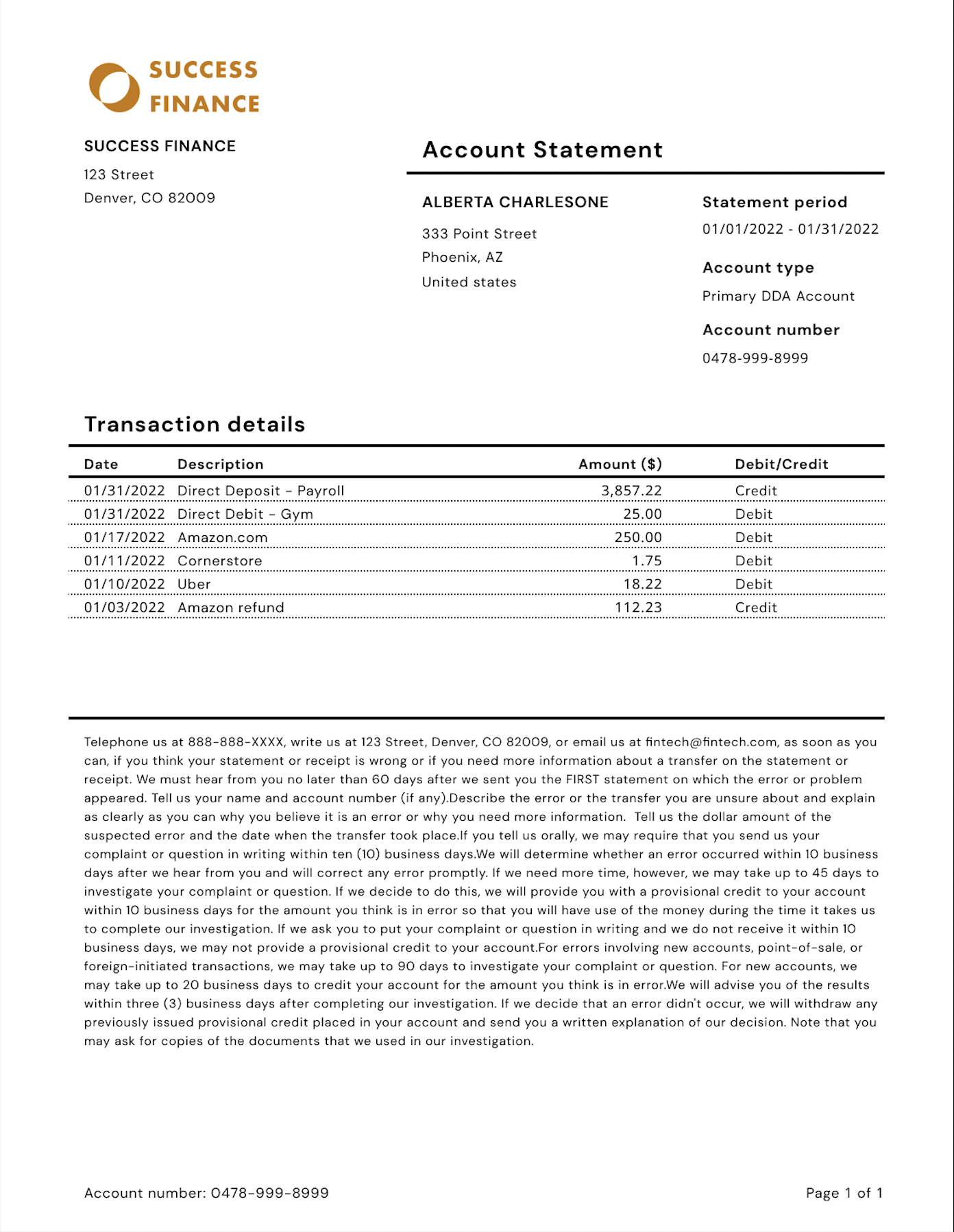

Here is a sample statement produced using the information provided by this API:

Webhook Events

This section assumes you are familiar with our webhook API. If not, please see the webhooks guide for more context.

When a statement is generated, a webhook notification will be sent to subscribers of event type STATEMENT.CREATED. The event will contain a full version of the statement payload, following the spec outlined in the Statements API specification.

Please note that if a statement contains an excessive number of transactions, the system may opt to return an empty list in the webhook notification to the subscriber due to technical limitations. This will be reflected in the payload with transactions_omitted set to "true" and an empty transactions attribute.

API Workflow

Step 1: List the statements for a given account

If statements are available for an account, you can retrieve a summarized list by calling GET /v0/statements, with an account_id query parameter:

curl --request GET \

--url https://api.synctera.com/v0/statements?account_id=37083b2c-d3f9-4a7f-b781-7342285c368e \

-H 'Accept: application/json' \

-H "Authorization: Bearer $apikey"

This route only gives high-level details about each statement. Once you know the ID of the statement you're looking for, you can retrieve details about that statement.

Step 2: Retrieve the details for a given statement

With a statement ID, you'll be able to pull detailed information about the statement:

curl --request GET \

--url https://api.synctera.com/v0/statements/a4554821-22c2-4053-8b50-768365b98c83 \

-H 'Accept: application/json' \

-H "Authorization: Bearer $apikey"

Transaction information will be omitted from the statement detail response payload in future versions of the API. We recommend that all existing clients migrate to calling the dedicated transactions endpoint instead of relying on the

transactionsattribute.

Step 3: List the transactions for a statement

With a statement ID, you'll be able to pull the list of transactions that pertain to that statement:

curl --request GET \

--url https://api.synctera.com/v0/statements/a4554821-22c2-4053-8b50-768365b98c83/transactions \

-H 'Accept: application/json' \

-H "Authorization: Bearer $apikey"

This list will only include posted transactions at the time of statement generation. These are also only returned to you in descending order of posted date.

Updated over 2 years ago